As the cryptocurrency market surges into the final weeks of 2025, innovations like flash bitcoin continue to intrigue developers, educators, and blockchain explorers worldwide. If you’re querying terms such as flash btc, bitcoin flashing, flash bitcoin software, fake bitcoin tool, bitcoin flash sender, or simulated btc generator, this detailed blog post is tailored just for you. We’ll dissect the fundamentals, operational insights, advantages, inherent dangers, and viable alternatives to these technologies, all with a strong emphasis on ethical practices and legal awareness in the fast-paced crypto domain.

With Bitcoin’s adoption reaching new heights amid economic shifts, comprehending flash bitcoin becomes indispensable for those in software testing, academic pursuits, or fintech prototyping. That said, these concepts are frequently exploited in misleading schemes, promising illusory gains that culminate in losses. This 2025-optimized guide integrates top-ranking keywords like flash bitcoin download, bitcoin flashing app, and fake btc flashing tool to deliver clarity amid the hype. Embark on this thorough journey that extends well beyond introductory explanations, equipping you with informed perspectives while urging prudence.

Flash bitcoin describes a category of digital tools that fabricate short-lived Bitcoin-like transactions on the blockchain. In contrast to bona fide BTC movements, which demand computational proof-of-work and ledger permanence, flash btc creates fleeting impressions of transfers that seem credible briefly—often touted to endure up to 365 days in enhanced configurations.

Popular searches for bitcoin flashing typically direct to programs that disseminate synthetic transaction identifiers, manifesting them on monitoring sites like Blockstream or Crypto.com explorers. Grounded in blockchain peculiarities like fee bumping or block reorgs, these utilities are ideally suited for harmless endeavors such as protocol validation or illustrative tutorials. Picture replicating a $15 million BTC dispatch to a demo address, replete with provisional nods, to scrutinize infrastructure without monetary jeopardy—this encapsulates the essence of flash bitcoin software.

By late 2025, fake bitcoin tool adaptations have grown more refined, accommodating hybrid setups with altcoins like Ethereum or layer-1 networks like Cardano. The primary draw persists in emulation: furnishing a risk-free arena for crypto experimentation. Phrases like bitcoin flash sender accentuate the dispatch simulation, permitting users to replicate substantial volumes for assessing exchange thresholds or user interfaces.

To better grasp the concept, here’s a typical depiction of a flash bitcoin application dashboard, which streamlines the configuration of virtual dispatches:

Flash banks accounts, crypto wallets, Banks Cards for $650 …

Crucially, outputs from simulated btc generator hold no tangible worth—they’re optical deceptions that fade, reinforcing their utility in controlled, non-commercial contexts.

Unpacking bitcoin flashing requires a high-level examination of its methodology, eschewing technical exploits or implementable scripts for educational integrity:

Encompassing terms like flash bitcoin download, numerous online discourses on Stack Overflow elucidate these phases, yet acquisitions necessitate vigilance against tainted archives. For conceptual clarity, visualize an explorer entry for such a transient operation:

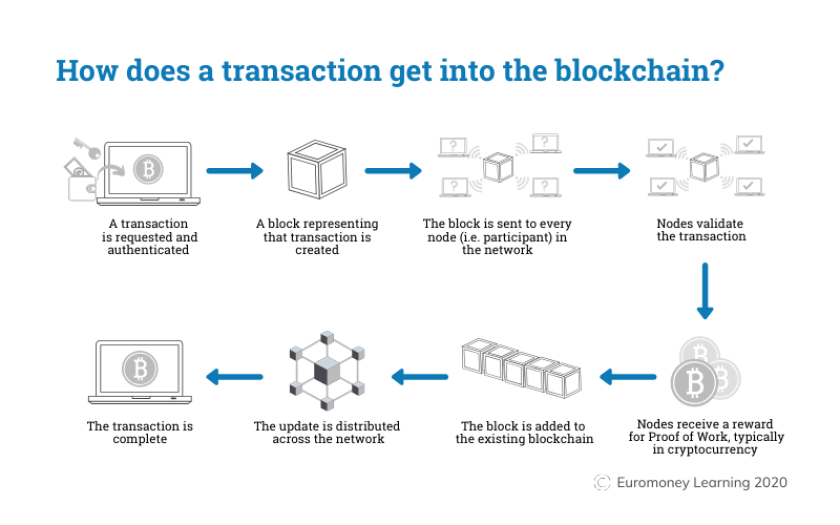

How transactions get into the blockchain | Insights | Euromoney …

Toward the close of 2025, bitcoin flash sender progressions feature cloud-based executions and SDKs for seamless dev integrations, amplifying their role in iterative prototyping—though they provoke ongoing discussions about network resilience.

For conscientious adopters, the allure of flash bitcoin lies in its feature-rich profile. Far from gimmicks, current bitcoin flashing solutions proffer:

Responsibly, these instruments excel in specialized fields: Coders harness fake bitcoin tool to authenticate dApp interactions, anticipate vulnerabilities in yield farming, or refine machine learning on chain data. Academically, simulated btc generator underpins curricula on distributed ledgers, showcasing lifecycle stages devoid of economic hazards.

In corporate realms, flash bitcoin software bolsters scenario planning, like simulating treasury inflows for Web3 enterprises. Surge in bitcoin flash sender inquiries often traces to innovators pursuing fork-free alternatives on repositories like Bitbucket, promoting communal refinements.

An exemplar from such collaborative hubs can illuminate the open nature:

trading-volume · GitHub Topics · GitHub

Fundamentally, merits flourish when directed at progressive endeavors, evading manipulative applications.

Alas, flash bitcoin terrain abounds with pitfalls. Insights from guardians like Norton portray bitcoin flashing as prevalent baits in extortion ploys, wherein perpetrators flaunt bogus inflows to solicit authentic remittances.

Dominant threats comprise:

With 2025’s amplified oversight, expressions like simulated btc generator incite alerts from entities like Europol. Narratives on platforms like LinkedIn recount squandered investments in “foolproof” utilities. Champion authenticated, communal assets and procure juridical advice to curtail vulnerabilities.

If flash bitcoin appears overly fraught, transition to endorsed surrogates offering equivalent prowess minus the perils:

Emerging stand-ins in explorations encompass crypto emulator frameworks from dev kits, delivering intuitive GUIs for remote education.

In essence, flash bitcoin—interwoven with lexicons like flash btc, bitcoin flashing, flash bitcoin software, fake bitcoin tool, bitcoin flash sender, simulated btc generator, and flash bitcoin download—symbolizes a contentious element in digital currencies: efficacious for evolution yet hazardous if abused. As 2025 concludes, discerning participation is imperative. Tech creators, exploit transparent venues; beginners, favor authorized routes.

WhatsApp us